Chapter 2 - Partnership

A partnership business is an organisation set up by a minimum of two and a maximum of twenty partners joining together to provide goods and services to customers with a view to make profit.

Advantages of forming a partnership business:

- More capital is available for investment.

- More ideas available to manage the business efficiently.

- Losses are shared among partners.

- A partnership is generally easier to form, manage and run.

- Partners can share the responsibility of the running of the business

Disadvantages of forming a partnership:

- Profits must be shared among partners.

- There is a risk of having dormant partners.

- Disagreement among partners may lead to dissolution of the business.

- Ordinary Partnerships are subject to unlimited liability, which means that each of the partners shares the liability and financial risks of the business.

A partnership business may be set up by a verbal agreement or a written agreement. This agreement is known as a partnership deed. This agreement may include the following:

- Amount of capital to be contributed by each partner.

- Interest on capital

- Interest charged on drawings

- Salary, bonus and commission

- Interest on partners loan

- Profit / Loss sharing ratio

In case there is no partnership agreement; the partnership act states the following:

- No interest on capital.

- No interest on drawings.

- No salary, bonus and commission.

- Profit and losses are shared equally.

- Interest on partner’s loan must be paid at 5% per annum.

The financial statements of a partnership business include:

- Income statement.

- Appropriation account.

- Current account.

- Statement of financial position.

Note : Partner’s current account may be prepared within statement of financial position

Interest on capital

This is allowed on partner’s capital to encourage them to invest more in the business.

Debit Appropriation account

Credit Current account

Interest on drawings

This is charged against partner’s drawings to discourage them to withdraw money from the business for their own use.

Debit Current account

Credit Appropriation account

Salary, Bonus and Commission

This is paid to partners for the skills and expertise they bring to manage the business.

Debit Appropriation account

Credit Current account

Interest on partner’s loan

This is paid on partner’s loan to encourage them to finance various projects of the business.

Debit Income statement

Credit Current account

Appropriation account

This is prepared to take into consideration the partnership agreement and to show the profit and loss to be shared among partners. An appropriation account may be prepared using the following format:

Appropriation account for the year ended 31st December | $ | $ |

Profit for the year (net profit after interest) | *** | |

Add interest on drawings: | ||

Partner A | *** | |

Partner B | *** | |

*** | ||

Less appropriations | ||

Interest on capital | ||

Partner A | *** | |

Partner B | *** | |

Salary / Bonus / Commission | *** | (***) |

Residual Profit / Loss | *** | |

Share of Profit | ||

Partner A | *** | |

Partner B | *** | |

*** |

Current account

A current account is prepared so as to keep fixed capital account balances. A current account may have a debit or a credit balance. If the current account of a partner has a credit balance then it is said to be a part of capital (added with capital). If the current account of a partner has a debit balance then it represents the amount due by the partner (deducted from capital). A current account may be prepared using the following format:

Current Account

A | B | A | B | ||

| Balance b/f | *** | Balance b/f | *** | ||

Drawings | *** | *** | Interest on capital | *** | *** |

Interest on drawings | *** | *** | Salary / Bonus / Commission | *** | *** |

**Share of loss | *** | *** | Interest on loan | *** | *** |

Balance c/d | *** | **Share of profit | *** | *** | |

| Balance c/d | *** | ||||

*** | *** | *** | *** | ||

Balance b/d | *** | Balance b/d | *** | ||

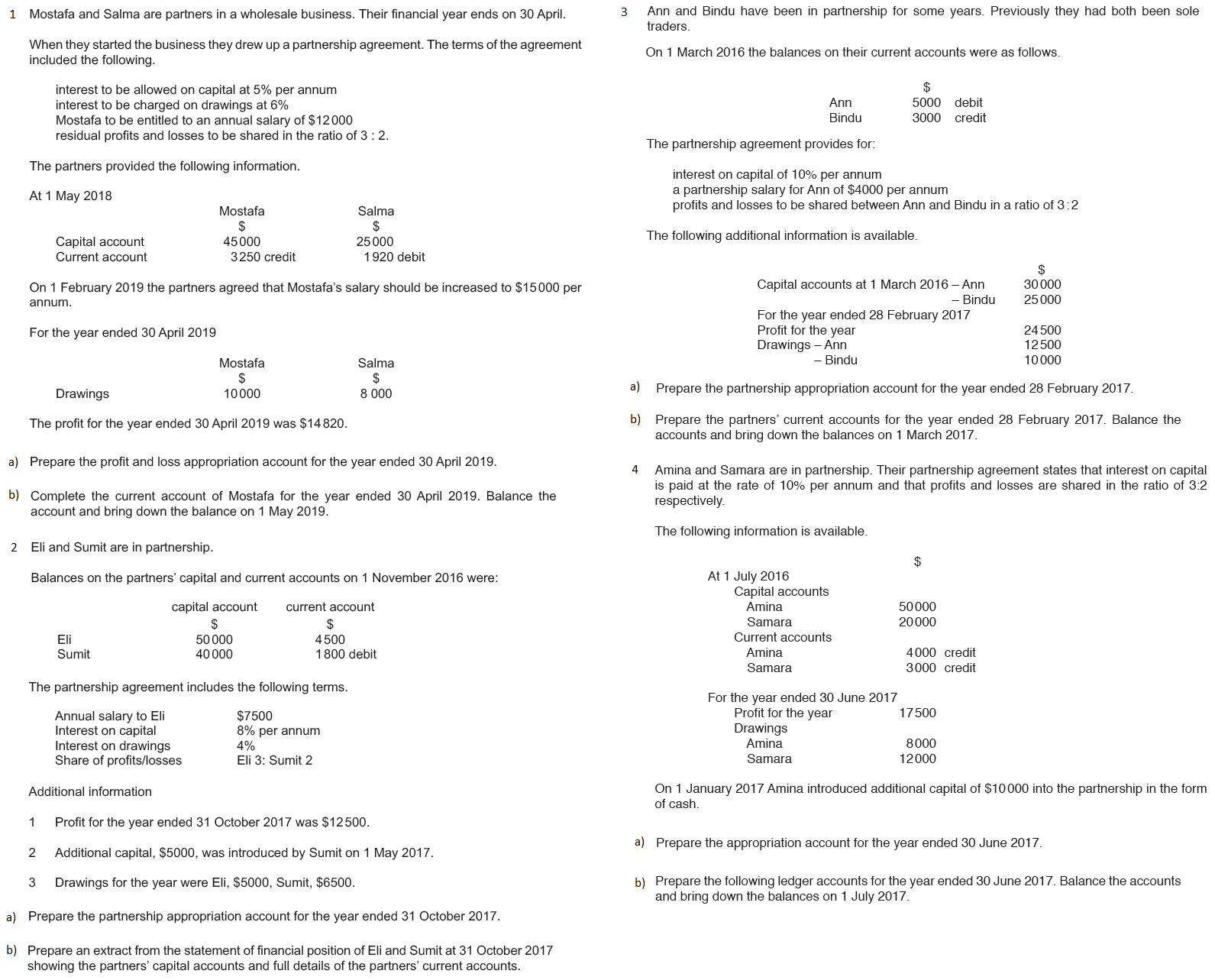

Question 1 and 2

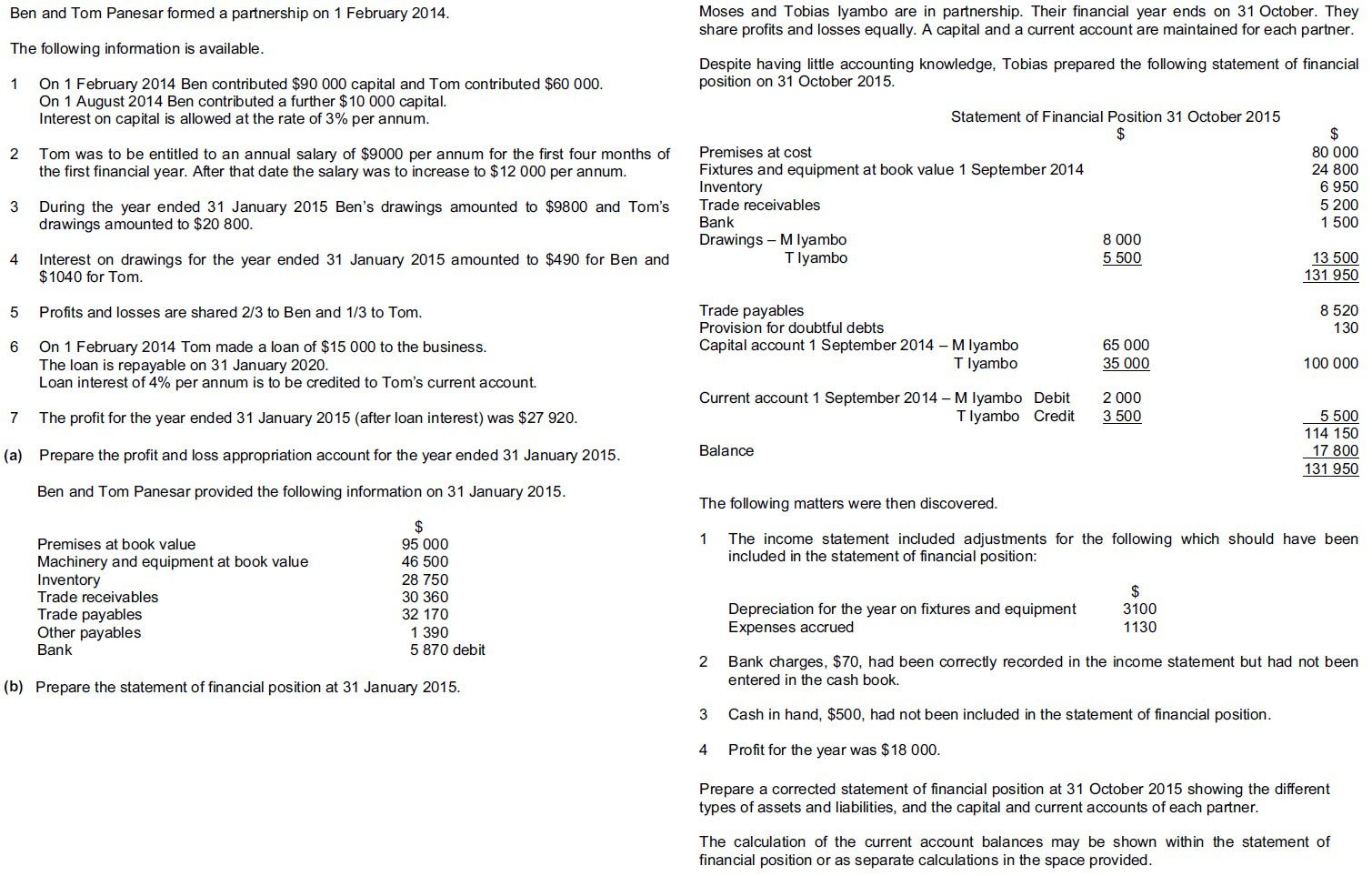

Question 3 and 4

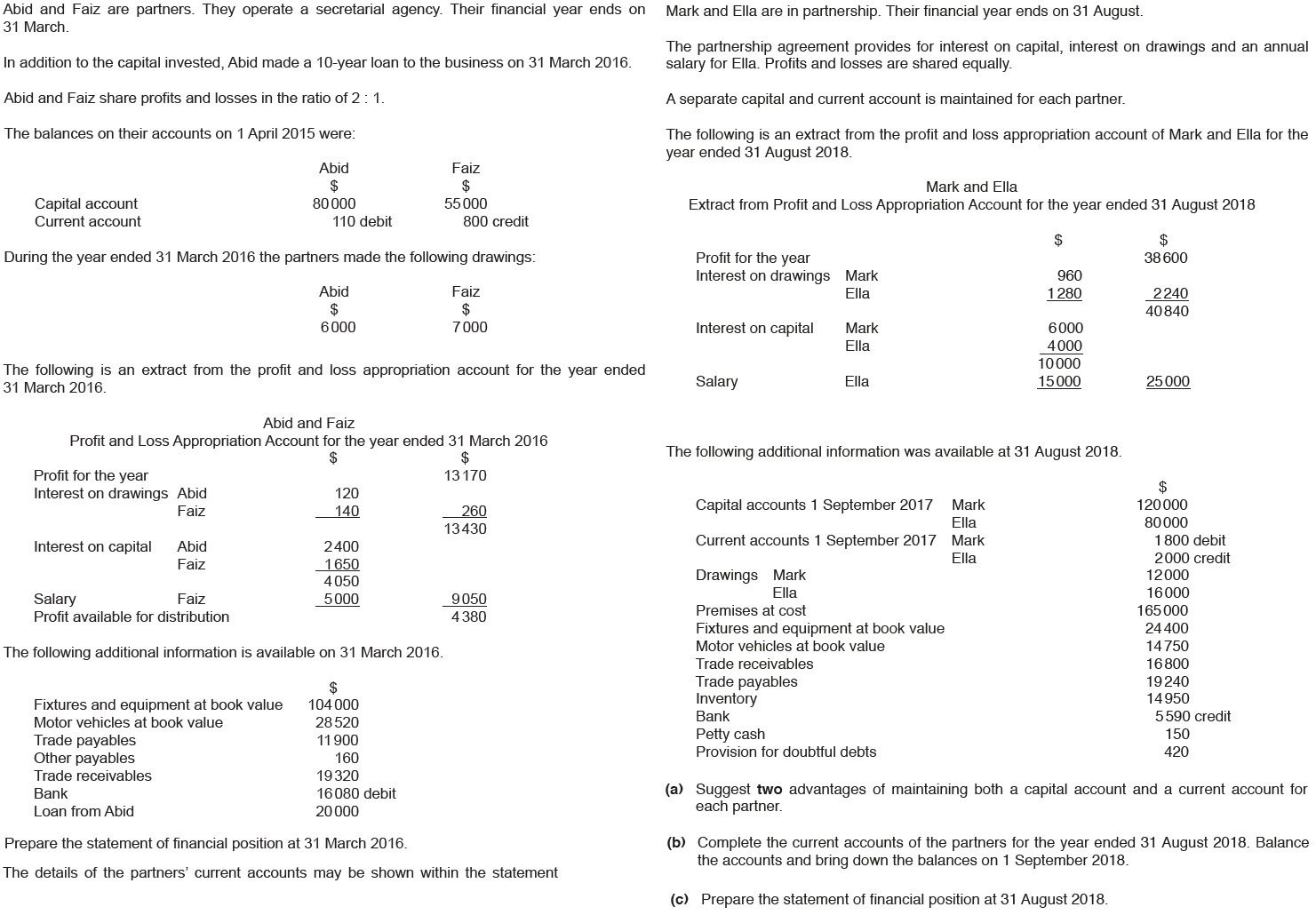

Question 5 and 6

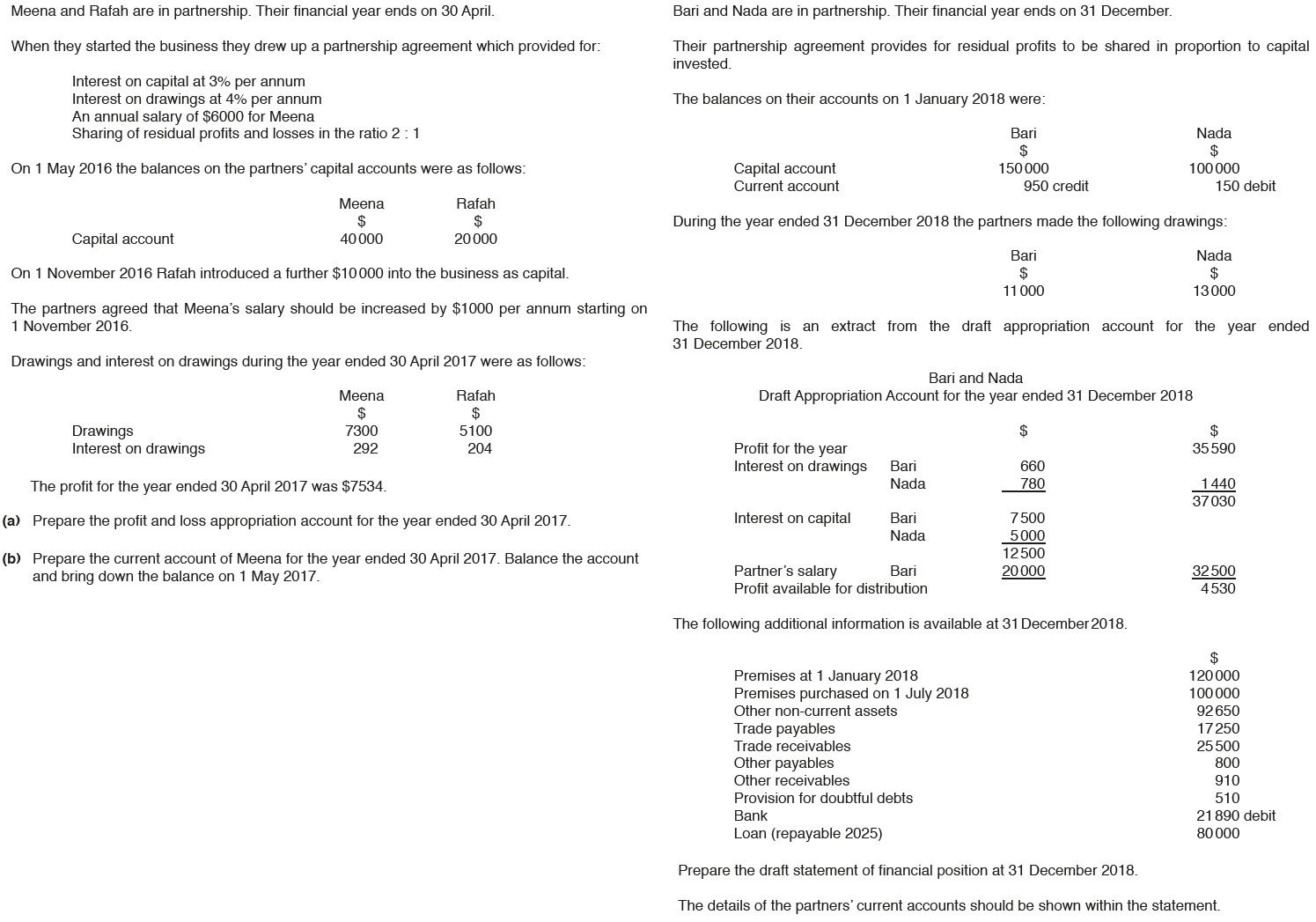

Question 7 and 8