Chapter 1- Final accounts of sole-trader

Format

Income Statement for the year ended 31st December 2018 | |||

$ | $ | ||

Sales / Revenue | **** | ||

Less sales return ( return inwards ) | (**) | ||

Net sales / Net revenue | **** | ||

Less cost of sales: | |||

Opening inventory | **** | ||

Purchases / ordinary goods purchased (less drawing of goods) | **** | ||

Add Carriage on purchases ( Carriage inwards ) | ** | ||

Less Purchases return ( return outwards ) | (**) | *** | |

Goods available for sales | *** | ||

Less Closing inventory | (****) | ||

Cost of sales | (****) | ||

Gross Profit | **** | ||

Add other income: | |||

Discount received | ** | ||

Decrease in Provision for doubtful debts | ** | ||

Interest received | ** | ||

Commission received | ** | ||

Gross income | **** | ||

Less expenses: | |||

Wages and salaries / Insurance / Advertising | *** | ||

Increase in Provision for doubtful debts | *** | ||

Rent and rates / General / Administrative | *** | ||

General / Sundry expenses / Selling & Distribution expenses | *** | ||

Discount allowed | *** | ||

Carriage on sales ( Carriage outwards ) | *** | ||

Commission Payable / Bad debts / Bank charges | *** | ||

Depreciation on Non Current assets | *** | ||

Interest on loan (Finance cost) | *** | ||

Total expenses | (***) | ||

Profit for the year | **** | ||

Statement of financial position as at 31st December 2018 | ||

$ | $ | |

Non Current assets (Cost – Accumulated depreciation) | ||

Property, plant and equipment | *** | |

Fixtures and Fittings | *** | |

Total non current assets | *** | |

Current Assets | ||

Closing inventory | *** | |

Trade receivables | *** | |

Cash and cash equivalents(Cash in hand & bank) | *** | |

Other receivables (Expenses prepaid / paid in advance) | *** | |

Total current assets | *** | |

Total Assets (Total non current assets + Total current assets) | **** | |

Equity | ||

Capital | *** | |

Add Profit for the year | *** | |

Less Drawings | (**) | |

Capital owned/Owner's capital | *** | |

Non Current liabilities | ||

Loan | *** | |

Capital Employed (Owner’s Capital + Non current liabilities) | *** | |

Current Liabilities | ||

Trade payables | ** | |

Other payables (Expenses due/accrued/outstanding/not yet paid) | ** | |

Bank overdraft (CR) | ** | |

Total current liabilities | ** | |

Equity and Liabilities (Capital employed + Total current liabilities) | **** | |

Q1. The following trial balance was extracted from the books of Eshna on 31st December 2018 | ||||

DR | CR | |||

$ | $ | |||

Revenue | 92200 | |||

Inventory-1st Jan 2018 | 2950 | |||

Purchases | 36900 | |||

Carriage inwards | 1400 | |||

Carriage outwards | 1500 | |||

Return inwards | 800 | |||

Return outwards | 600 | |||

Discount allowed | 480 | |||

Discount received | 500 | |||

Wages and salaries | 3520 | |||

Rent and rates | 1640 | |||

Advertising | 2560 | |||

Interest paid on bank loan | 950 | |||

Heat and Light | 430 | |||

Machinery | 44000 | |||

Equipment | 36000 | |||

Fixtures and Fittings | 16000 | |||

Trade Receivables | 19000 | |||

Cash and Bank | 13600 | |||

Trade payables | 14430 | |||

10% Loan from Bank (2030) | 11000 | |||

Capital | 70000 | |||

Drawings | 7000 | |||

188730 | 188730 | |||

Additional information | ||||

1. Inventory at 31st December 2018 amounted to $ 5 700 | ||||

2. Wages of $ 600 was not yet paid(outstanding) | ||||

3. Rent $ 300 was paid in advance. | ||||

4. Advertising $ 400 was prepaid. | ||||

5. Heat and light due(accrued) amounted to $ 250 | ||||

6. Eshna took goods from the business for her own use valued at $ 800. | ||||

7. Bank charges amounting to $ 200 was not taken into consideration. | ||||

8. Interest on the bank loan was still due. | ||||

Required | ||||

a) Income statement for the year ended 31st December 2018 | ||||

b) Statement of financial position as at 31st December 2018 | ||||

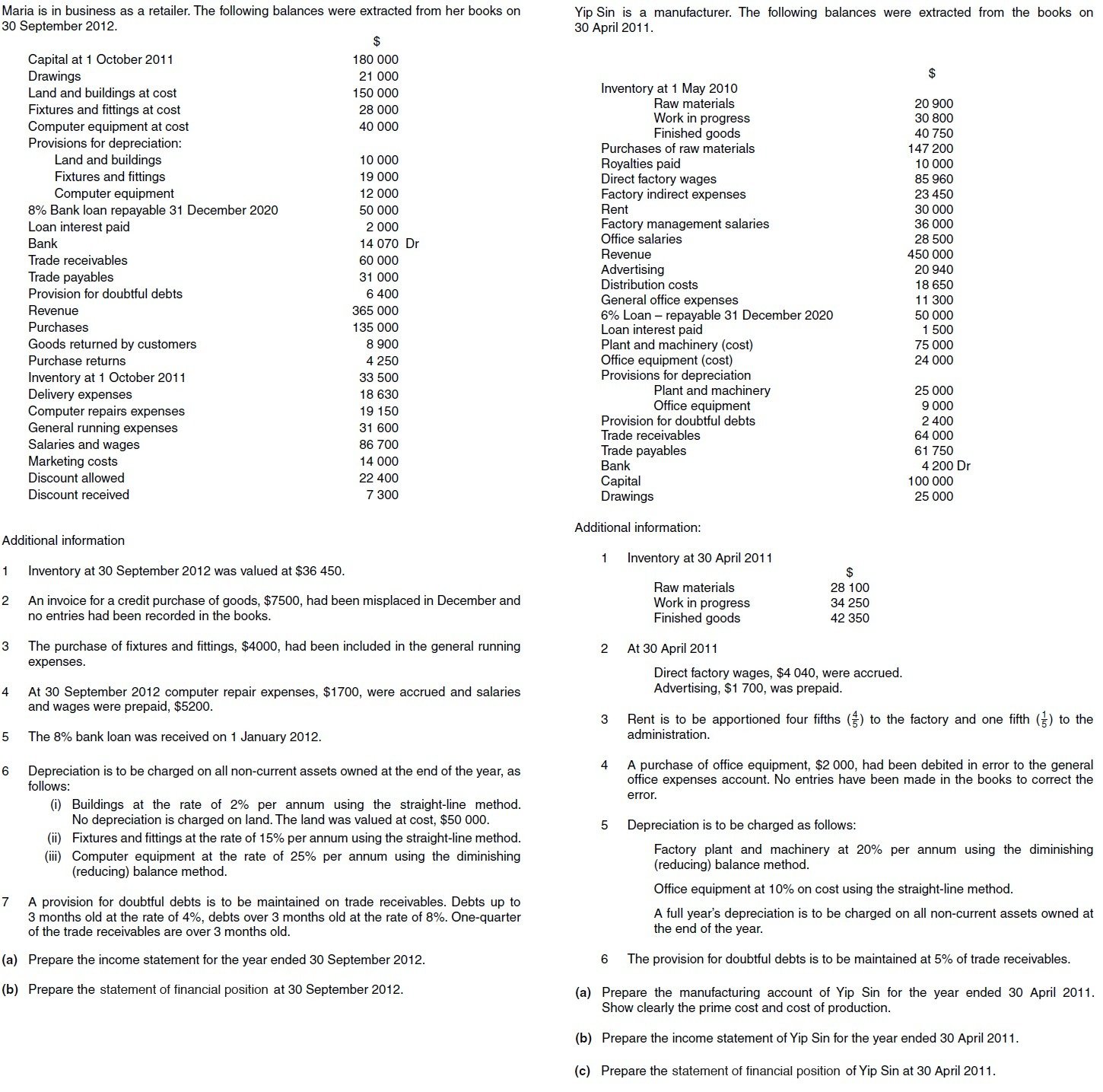

Question 2 and 3

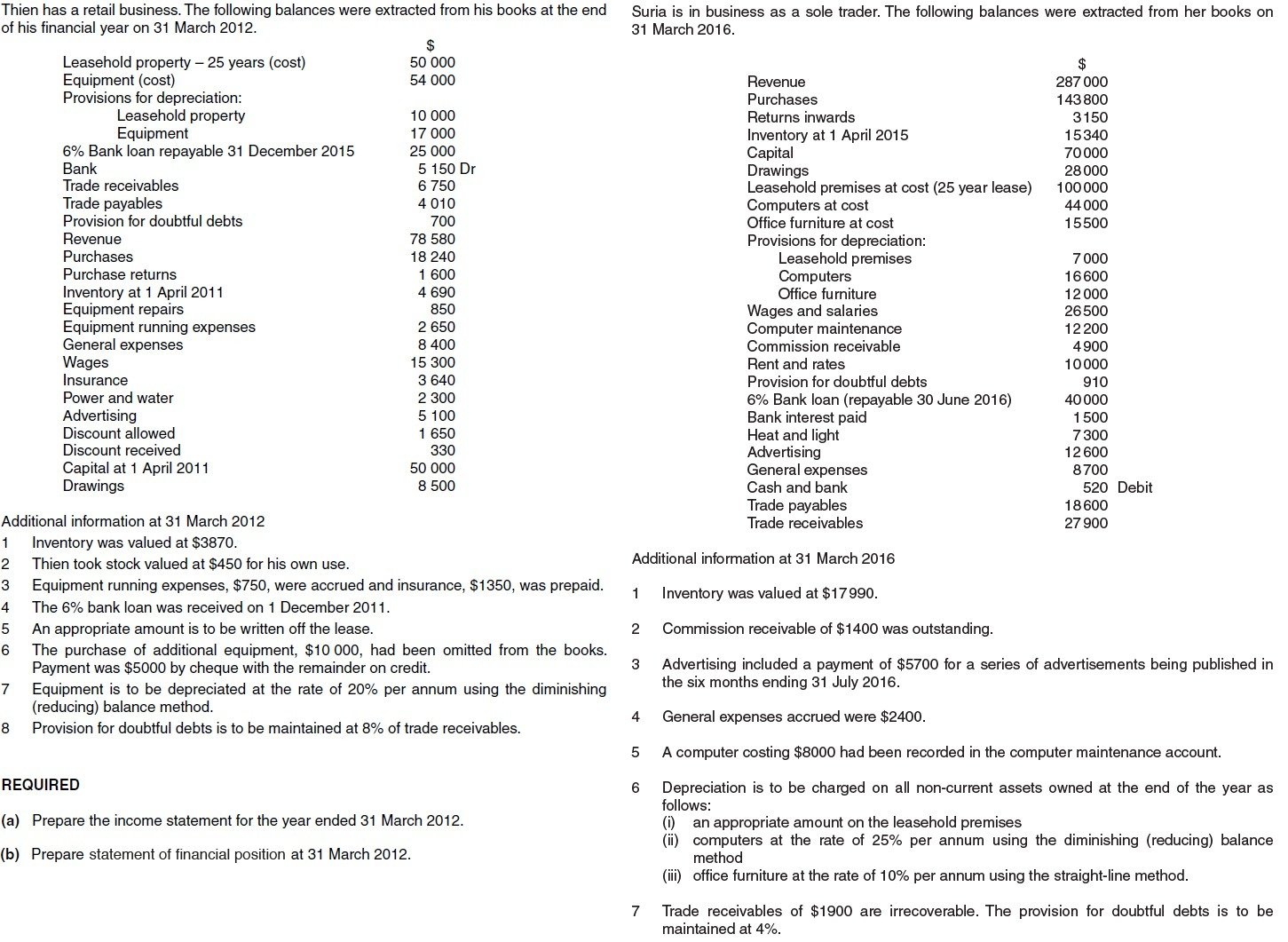

Question 4 and 5